|

New Page 2

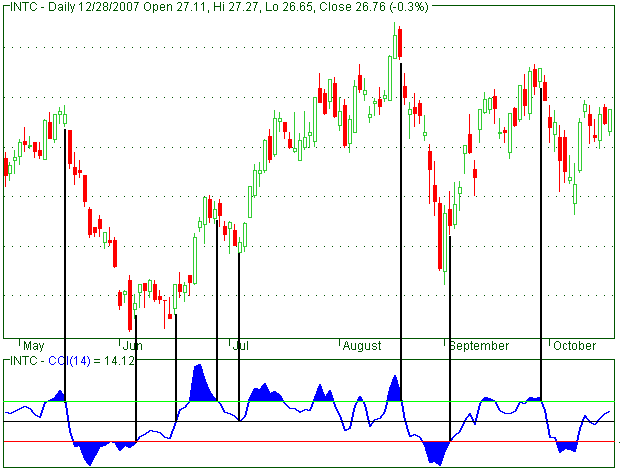

Commodity Channel Index

The Commodity Channel Index (CCI) is an oscillator originally introduced

by Donald Lambert in an article published in the October 1980 issue of

Commodities magazine (now known as Futures magazine).

Since its introduction, the indicator has grown in popularity and is now a

very common tool for traders in identifying cyclical trends not only in

commodities, but also equities and currencies. The CCI can be adjusted to

the timeframe of the market traded on by changing the averaging period.

Calculation

The CCI

is calculated as the difference between the typical price of a commodity

and its simple moving average, divided by the mean deviation of the

typical price. The index is usually scaled by a factor of 1/0.015 to

provide more readable numbers:

There

are 4 steps involved in the calculation of the CCI:

-

Calculate the last period's Typical Price (TP) = (H+L+C)/3 where H = high,

L = low, and C = close.

-

Calculate the 20-period Simple Moving Average of the Typical Price (SMATP).

-

Calculate the Mean Deviation. First, calculate the absolute value of the

difference between the last period's SMATP and the typical price for each

of the past 20 periods. Add all of these absolute values together and

divide by 20 to find the Mean Deviation.

-

The

final step is to apply the Typical Price (TP), the Simple Moving Average

of the Typical Price (SMATP), the Mean Deviation and a Constant (.015) to

the following formula:

CCI = ( Typical Price - SMATP ) / ( .015 X Mean

Deviation )

Interpretation

The Commodity Channel Index is often used for detecting divergences from

price trends as an overbought/oversold indicator, and to draw patterns on

it and trade according to those patterns. In this respect, it is similar

to bollinger bands, but is presented as an indicator rather than as

overbought/oversold levels.

The CCI typically oscillates above and below a zero line. Normal

oscillations will occur within the range of +100 and -100. Readings above

+100 imply an overbought condition, while readings below -100 imply an

oversold condition. As with other overbought/oversold indicators, this

means that there is a large probability that the price will correct to

more representative levels.

How

to use CCI

Buy or

sell signals happen 20 - 30 % of the time while from 70 up to 80 % of time

Commodity Channel Index's value is fluctuating between +100 and -100. It's

supposed that if CCI overcomes the level of +100 from below upwards, it

means that the currency pair is moving in the direction of the strong

ascending trend, thus there is a clear purchase signal. And once CCI goes

under +100 the position is supposed to be closed on a return signal. At

the same time, it's considered that if Commodity Channel Index moves to

-100 point from top to down, it means that the currency pair is meeting a

strong descending trend, and there's a sale signal. As soon as CCI again

crosses the level of -100 this position is considered closed.

One can

treat break of trend lines formed on the indicator as input or output

signals from a position. At overbought - above +100 - the break of the

trend line downwards is supposed a sale signal and at an oversold level -

below-100 - the break of the trend line upwards is supposed a signal to

growth of the market. Thus these lines are also based on the connection of

consecutive maxima or minima.

|